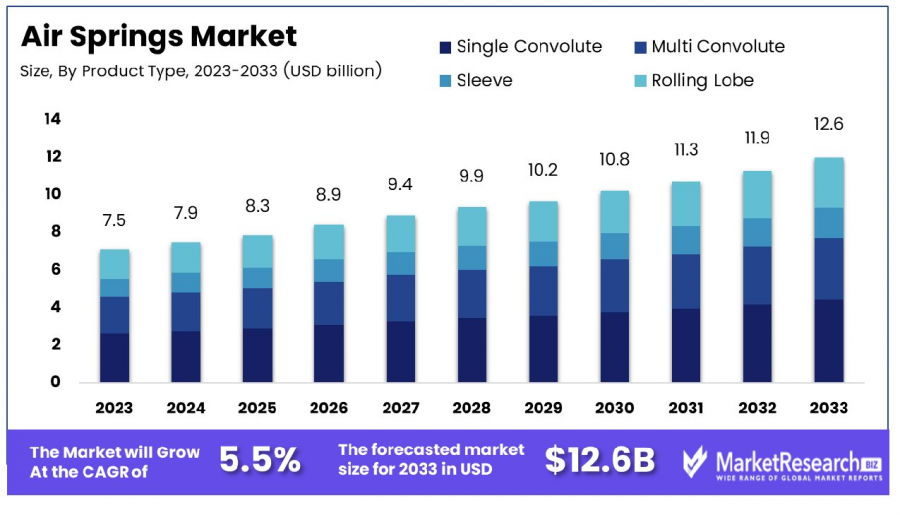

Air Springs Market to Grow to USD 12.6 Bn by 2033, CAGR 5.5% (2024-2033)

Global Air Springs Market to Grow from USD 7.5 Billion in 2023 to USD 12.6 Billion by 2033 with a CAGR of 5.5%

NEW YORK, NY, UNITED STATES, January 31, 2025 /EINPresswire.com/ -- Market Overview

The Global Air Springs Market was valued at USD 7.5 Bn in 2023. It is expected to reach USD 12.6 Bn by 2033, with a CAGR of 5.5% during the forecast period from 2024 to 2033.

The air springs market is a specialized segment within the automotive and industrial sectors, focusing on the production and distribution of air suspension systems. These systems use air-filled rubber bellows to provide cushioning, vibration isolation, and load-bearing capabilities. They are widely used in vehicles, including commercial trucks, buses, and luxury cars, as well as in industrial machinery and railway systems. The market is driven by the demand for enhanced ride comfort, vehicle safety, and operational efficiency.

The air springs market is poised for steady growth, fueled by increasing demand for advanced suspension systems in both automotive and industrial applications. The rise in commercial vehicle production, coupled with the growing preference for luxury vehicles, is a key driver. Government investments in infrastructure development, particularly in emerging economies, are further propelling the market.

For instance, investments in public transportation systems and railway modernization projects are creating significant demand for air springs. Additionally, stringent regulations related to vehicle safety and emissions are pushing manufacturers to adopt advanced suspension technologies that improve fuel efficiency and reduce environmental impact. These factors, combined with the ongoing trend of vehicle electrification, are expected to sustain market growth over the coming years.

The air springs market presents ample opportunities for both new entrants and established players to expand their business. For new players, the growing demand for lightweight and durable air springs in electric vehicles (EVs) offers a lucrative entry point. Existing players can capitalize on technological advancements, such as smart air suspension systems with integrated sensors, to differentiate their offerings.

Collaborations with automotive OEMs and aftermarket service providers can further enhance market penetration. Additionally, the increasing adoption of air springs in industrial applications, such as manufacturing and construction equipment, opens new revenue streams. By focusing on innovation, strategic partnerships, and geographic expansion, businesses can strengthen their position in this evolving market.

Curious About Market Trends? Request Your Complimentary Sample Report Today: https://marketresearch.biz/report/air-springs-market/request-sample/

Key Takeaway

-- The Global Air Springs Market is projected to grow from USD 7.5 billion in 2023 to USD 12.6 billion by 2033, at a CAGR of 5.5%, driven by the growing automotive industry, demand for lightweight suspension systems, and increasing adoption in luxury and electric vehicles.

-- Rolling Lobe air springs dominate with a 45% market share, favored for their durability and high-load performance.

-- OEMs lead with a 60% share, driven by direct integration into vehicle manufacturing for compatibility and reliability.

-- Trailers & Trucks hold a 50% share, reflecting the demand for robust suspension systems in heavy-duty vehicles.

-- North America leads with a 35% market share, supported by a strong automotive industry and high demand for commercial and luxury vehicles.

Use Cases

Automotive Industry

Air springs are commonly used in the automotive sector, particularly in commercial vehicles such as trucks, buses, and trailers. They provide a smooth ride by absorbing road shocks and adjusting vehicle height. Manufacturers are increasingly integrating air springs into suspension systems to enhance comfort, reduce wear on tires, and improve fuel efficiency.

Passenger Vehicles

In the passenger vehicle market, especially luxury and high-performance cars, air springs are used to provide adjustable suspension. These systems allow for improved ride comfort and handling, adapting to road conditions and the vehicle’s load. Car manufacturers use air springs to offer customizable ride experiences for drivers and passengers.

Railway Industry

Air springs are crucial in railway systems, particularly for heavy-duty and high-speed trains. They improve ride quality, reduce vibrations, and protect tracks from excessive wear. Trains equipped with air suspension systems offer a more stable and comfortable journey for passengers, while also lowering maintenance costs for train operators.

Industrial Machinery

In industrial settings, air springs are used in machinery to reduce vibrations, stabilize equipment, and provide load-bearing support. They help enhance the longevity and efficiency of machines in manufacturing plants, ensuring smooth operation and minimizing downtime caused by equipment failure or wear.

Commercial and Recreational Vehicles

Air springs are widely used in commercial and recreational vehicles, such as RVs and camper vans. These systems allow for smoother handling when the vehicle is loaded, ensuring stability and comfort on long journeys. They also enable easy height adjustment for loading and unloading cargo, improving the overall functionality and safety of these vehicles.

Driving Factors

Automotive Industry Growth: The expanding automotive sector, particularly commercial vehicles, drives significant demand for air springs. These components are essential for vehicle suspension systems, providing better ride comfort and load management. Manufacturers are increasingly adopting air springs in luxury vehicles and heavy-duty trucks to improve vehicle performance and driver comfort. The growing emphasis on vehicle ride quality and handling stability has made air springs a preferred choice over conventional springs.

Industrial Applications Expansion: Air springs are finding increased use in industrial machinery and equipment. Manufacturing facilities use them for vibration isolation in sensitive equipment, machine leveling, and load handling. The growth in automated manufacturing processes has boosted demand for air springs in industrial applications where precise movement control and vibration dampening are crucial.

Rail Transport Development: The expansion of rail transportation networks globally has increased demand for air springs used in rail suspension systems. Modern trains require sophisticated suspension systems for passenger comfort and stability at high speeds. Air springs provide the necessary cushioning and height adjustment capabilities, making them essential components in railway applications.

Technological Advancements: Innovations in air spring design and materials have improved their durability and performance. New materials like advanced rubber compounds and reinforced fabrics extend product life and reliability. Smart air springs with integrated sensors for monitoring pressure and performance are emerging, aligning with Industry 4.0 trends.

Infrastructure Development: Growing infrastructure projects, especially in developing countries, boost demand for construction and material handling equipment that uses air springs. These components are crucial in construction machinery where load handling and stability are important. The increasing focus on infrastructure modernization in developed countries also drives replacement demand.

Report Segmentation

By Product Type

• Single Convolute

• Multi Convolute

• Sleeve

• Rolling Lobe

By Sales Channel

• OEMs

• Aftermarket

By Application

• Passenger Cars

• Buses

• Trailers & Trucks

• Light Commercial Vehicles

• Railways

• Industrial

Ready to Act on Market Opportunities? Buy Your Report Now and Get 30% off: https://marketresearch.biz/purchase-report/?report_id=47236

Regional Analysis

North America holds a significant 35% share of the global air springs market, thanks to several factors that contribute to its dominance. The region benefits from the presence of major market players, advanced manufacturing capabilities, and a strong automotive industry. The United States, in particular, plays a crucial role in driving market growth due to high demand for commercial vehicles and luxury automobiles that often feature air suspension systems.

Air springs are preferred in commercial and luxury vehicles because they offer improved ride comfort, better load handling, and enhanced vehicle stability. The growing need for high-performance suspension systems in both the commercial and luxury segments further fuels demand for air springs.

Additionally, North America's established automotive infrastructure supports the widespread adoption of air suspension technology. As manufacturers continue to innovate and improve air spring systems, the region's market share is expected to remain strong, with continued growth in both the automotive and transportation sectors.

Growth Opportunities

Automotive Industry Growth: The increasing demand for comfort and safety in vehicles presents a significant opportunity for air springs. As the automotive industry continues to grow, especially in emerging markets, the adoption of air springs in passenger cars, commercial vehicles, and heavy-duty trucks is expected to rise.

Aftermarket Sales: There is a substantial opportunity in the aftermarket for air springs. As vehicles age, the need for replacement parts increases. Companies can focus on providing high-quality, durable air springs to cater to this demand, ensuring customer satisfaction and repeat business.

Technological Advancements: Investing in research and development to create more advanced air springs can provide a competitive edge. Innovations such as self-leveling air springs, adaptive damping systems, and lightweight materials can attract customers looking for enhanced performance and efficiency.

Expansion into New Applications: Beyond the automotive industry, air springs can be used in various applications such as industrial machinery, railway systems, and aerospace. Exploring these new markets can open up additional revenue streams and reduce dependency on a single industry.

Sustainability Initiatives: As environmental concerns grow, there is an opportunity to develop eco-friendly air springs. Using sustainable materials and manufacturing processes can appeal to environmentally conscious consumers and businesses, providing a unique selling proposition.

Key Players

• Continental AG

• Bridgestone Industrial

• Wabco Holdings Inc.

• Vibracoustic SE

• Sumitomo Electric Industries, Ltd.

• ThyssenKrupp AG

• Trelleborg AB

• VDL Groep

• VB AirSuspension

• Hendrickson L.L.C.

• Tata AutoComp Systems

• BWI Group

• Stemco

Not Sure? Request a Sample Report and See How Our Insights Can Drive Your Business: https://marketresearch.biz/report/air-springs-market/request-sample/

Conclusion

In conclusion, the markets analyzed are all experiencing growth driven by evolving consumer preferences, technological advancements, and increasing demand for customized, high-quality products. Key trends, such as the adoption of sustainable practices, integration of smart technologies, and rising disposable incomes, are shaping the competitive landscape. While challenges such as market saturation, price sensitivity, and regional differences persist, opportunities abound for companies to capitalize on niche segments, leverage digital platforms, and innovate to meet the specific needs of their target audiences. As these industries continue to expand, businesses that adapt to changing trends, prioritize customer-centric strategies, and invest in innovation will be well-positioned for long-term success.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Automotive Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release